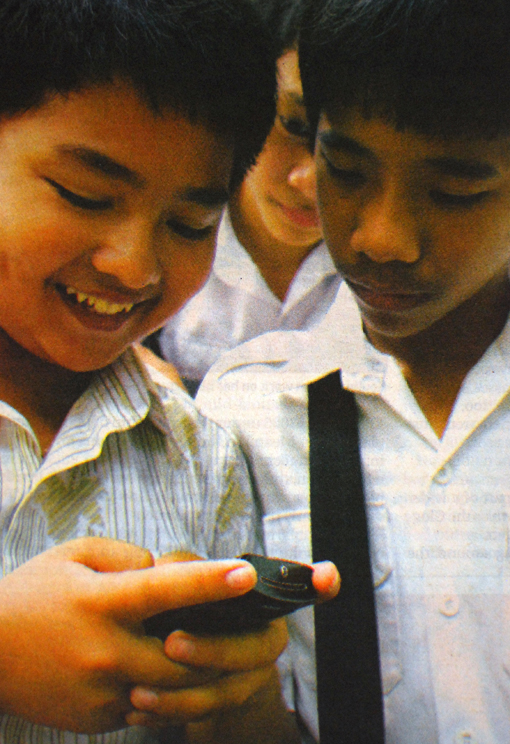

AS the global economic slips into recession, domestic mobile phone operators remain confident that Cambodia – a country with low mobile penetration rates and large untapped markets – will continue to see a boom in mobile expansion. But with eleven mobile operators currently licensed to operate in Cambodia, eight of which are now online, industry insiders say consolidation is likely once the market settles and the booming sector starts to mature.

“Cambodia provides a unique opportunity,” said Syed Azmeer, Chief Marketing Officer of Hello mobile. “If you look at the whole Mekong Basin or Indochina markets, this is one of the last untapped markets.” Hello, which is owned by Telekom Malaysia, launched its new 081 phone prefix last month, and Azmeer said economic development and a heavy investment in infrastructure would drive the sector forward. “We’ve seen a good uptake in the last two years. We have a lot more people who can afford to own a phone now,” he added.

Thomas Hundt, CEO of Smart Mobile – a local subsidiary of the Russian Latelz Co Ltd, which entered the Cambodian market as its eighth operator in February, said that the prospects for growth were “significant”, and would compensate for any downturn in the global economy. “Despite the economic crisis, Cambodia is still developing. In countries where development is taking place, telecommunications is one of the vital drivers,” he said.

Despite the heated competition in the Cambodian market, Hundt said that “poor” customer service levels and an undistributed market gave a lot of room for operators to carve out their own niche. “Despite the fact that there is a clear market leader, there are still significant developments to come in all dimensions of telecommunications,” he added. “There is a lot of potential and a lot of investments have been made.”

While mobile phones have become ubiquitous in Phnom Penh and the major provincial towns, their presence conceals the fact that the market is still largely in its infancy. Hello CEO Yusoff Zamri said that although Cambodia has a SIM card penetration rate of around 30 percent, the figure overrated the true number of mobile users. He said that since many locals own more than one phone, the estimated 3.8 million SIM cards in circulation translated to perhaps 3 million actual subscribers – leaving a market of nearly 12 million who are yet to enter the sector. He added that Telekom Malaysia has invested “in excess of $100 million” in capital investments for the coming years, an indication of the company’s confidence in the sector’s growth.

But in an unsettled, price-sensitive mobile market, some say that eight operators – leaving aside the three new players that have been issued licenses by the government – will saturate the local market and that local costs, while a benefit to consumers, would drive down profitability.

“Eight operators is too many,” said Pasi Koistinen, CEO of Star Cell Mobile, owned by local operator Applifone Co Ltd. While low prices would be a boon for consumers, he said that there would be “no room” for new entrants, and that a price-war would undercut companies’ ability to conduct profitable business. Some sort of consolidation was therefore inevitable, he said, and that the eleven licenses currently issued would likely shrink as firms merge or bow out of the market. Indeed, Asia’s most developed economies have substantially consolidated local mobile operations: just three major state-owned operators make up the majority of the Chinese market, while Japan has five operators and Thailand four. Vietnam also has just four major players, although several new ventures are set to come online this year.

Hundt from Smart Mobile said that consolidation would take place “in the medium to long term”, but that its exact form was hard to guess. “I don’t know any country in the world where eight or nine MP operators are in place,” he said. “But how this consolidation will look, I am unsure.”

One method, said Hello CEO Yusoff Zamri, was direct government intervention in the sector. Zamri said Cambodia could follow the same path as Malaysia, which had eight operators until the government stepped in and forced them to merge with one another. “What the government did was to force the companies to consolidate and let them talk amongst themselves and [work things out]. A couple years later the number went down to three,” he said. However, he added that consolidation depended largely on how willing the government was to intervene in a freely competitive market to “push” for consolidations.

In an interview with the Post March 23, So Khun, Minister of Posts and Telecommunications, acknowledged that there were natural limits to the number of operators who could profitably operate in the domestic market, but that its international free trade obligations preventing it from forcing companies to consolidate. “I think Cambodia should have only three mobile service providers, but we can’t limit the number we have as Cambodia is a member of the World Trade Organisation,” he said.

Mao Chakrya, Director General of the Ministry, said that the low penetration rate showed that the industry still has a fair way to develop, and that the government would allow open competition to determine which operators prosper. “Providers hope there is more room to grow. If they didn’t see any business potential, they wouldn’t come into this sector,” he said. “If they can’t survive in the Cambodian economy, they wouldn’t be coming.”

How the sector will settle over the next ten years will determine in large party on how operators can differentiate their services from one another. Aside from the standard virtues of value for money and reliability, another potential frontier is technological innovation. With the launch of the qb network last March, 3G mobile internet services were pushed to the forefront of the Cambodian market, and industry figures who spoke with the Post said the adoption of new technologies would be one way of giving them an edge over their competition.

Mao Chakrya said three operators – including M-Fone, Mobitel and Cambodia Advance Communications, which runs the qb network – were operating mobile internet services, and Hundt said that Smart Mobile, in addition to plans to expand its coverage into the provinces, will introduce a 3G service later in the year.

Azmeer from Hello said similarly that the adoption of new electronic credit top-up technologies, and other services allowing people to transfer credit from phone to phone, would increase the willingness of people adopt mobile technologies. He also said the growing integration between banking and telecommunications – as with ANZ Banking Group’s Wing mobile payments service – could push the industry in new directions. “What’s important here is the synergy between the bank and the telco,” he said, adding that Hello was the first company to give its customers access to Wing services. “We have the capacity and the security on the network to provide that [service].” WITH REPORTING BY HOR HAB

[Published in the Phnom Penh Post, March 31, 2009]